The most recent BBBT presentation was from Dell Software. Peter Evans, Sr. Integrated Solutions Development Consultant , and Steven Phillips, Product Marketing Manager – Big Data & Analytics, gave us an overview of Dell’s architecture for addressing business intelligence (BI).

What they’re working to accomplish is, no surprise, ensure that Dell’s hardware is able to be present throughout the BI supply chain. For that, they’re working to be application agnostic, though they mislabel it as “no lock-in.” What they’re saying is you can change your software vendors and Dell will still be there. There’s no addressing true lock-in, the difficulty in changing one software vendor to another based on level of openness to data in systems and other costs of moving.

One marketing nit that caught a number of us was Peter’s early claim that Dell is “probably the third largest software company in the world.” Right… First, as a now privately held company, we have no way to confirm that. Second, I’m not sure if he knows just how much revenue is needed to be near the top of that list.

IT First

Far too many young firms are overselling BI as something that will let business “avoid IT.” That’s not only impossible, it wouldn’t make sense if it was possible. IT has a clear place in organizing infrastructure, providing consistency, helping with compliance and doing other things a central organization should do.

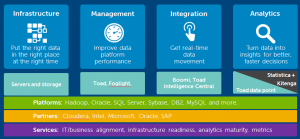

Dell has started with IT. They’re used to dealing with IT and their solution is focused on helping IT enable business. What’s not clear is how well they can do such a thing in the new world. They’ve pieced a lot of different applications into an architecture and that would seem to require heavy IT involvement in much of what’s being provided.

On the good side, that knowledge means they better understand true enterprise business needs. Unlike many vendors, Dell has regulatory and statutory compliance at the forefront, very clear in its marketechture slides. While most companies understand they have to mention compliance, it’s usually people dealing with corporate business groups such as IT and legal who understand just how critical compliance is.

Neither Peter Evans nor Steven Phillips spoke clearly to the business user, the want for speed and flexibility for them. While younger companies need to move more to addressing the importance of IT, Dell needs to more strongly focus on the business customer, the ones who are often in charge of the BI and related software projects and spending.

Boomi Suggest

The technical piece that stuck with me the most was the discussion of Boomi Suggest. Boomi is Dells integration tool. Within it, there’s a cloud-based tool called Boomi Suggest. If users subscribe to it, the product tracks data linkages and the de-natured information is kept to help other customers more quickly map data sources and targets.

Mr. Evens says that Boomi Suggest has a database that now contains more than 16 million links. The intelligence on top to that then is able to provide a 92% accuracy rate in analyzing new links. The time savings that alone suggests is a major decision driver that should not be overlooked.

A Great Case Study: Asthma

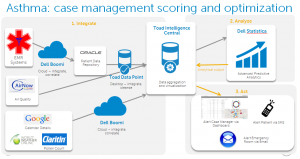

While the case study didn’t address enough of the end user issues of timeliness, flexibility and more, it was a very interesting case study from an inclusive standpoint. The Dell team focused on asthma case management to show the breadth of data sources, the complexity of analytics and a full process that could be generalized from the healthcare sector in order to support their full platform message.

As you can see, they are doing a lot of things with a variety of information, but they’re also doing it with a variety of products.

Summary

Dell’s decades of working with IT has helped it look at BI with a more complex eye that can address many of IT’s concerns. What we saw was an almost completely IT solution and message. While BI focused companies are going to have to move down and address important IT messages, Dell must go in the opposite direction. Unless the team can broaden their message to address the solution to more business teams, Dell’s expansion in the market will be severely limited because it’s the business groups that write the checks.

The presentation shows a great start. However, the questions are if Dell can simplify the architecture to make it less complex, potentially by merging a number of their products, and whether or not they can learn about those folks they don’t have a history of directly understanding: The business user. If they can do that, the start will expand and Dell Software can help in the BI market.